DailyPost 1824

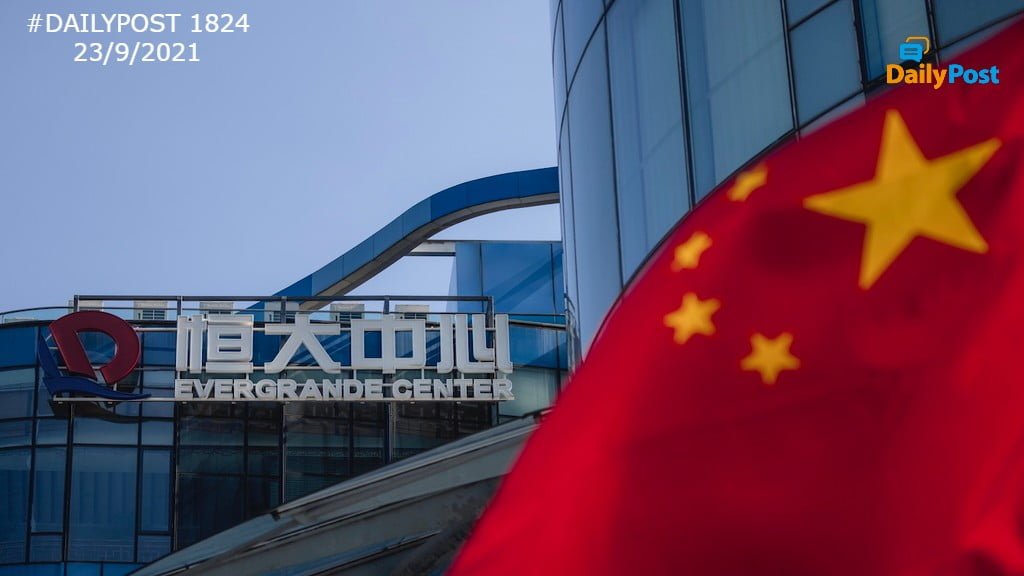

EVERGRANDE

It has different names in different parts of the world, the financial mess which it ends up in, remains the same. Now it is Evergrande of the famed Shenzhen city in China, famed for the super Silicon Valley pace of digital existence. In 2008 in the US, it was Lehman Brothers facing an unprecedented loss due to the continuing subprime mortgage crisis. Did the world not learn the regulatory lessons taught by the financial crisis of 2008. Don’t we have the capability to have regulatory agencies and mechanisms which are beyond the check box tick and cross levels. Can brick and mortar business viability be thrown into the dustbin? If a controlled economy like China can find one of leading companies in this sort of financial mess, then it is very difficult to comment on the financial health of any nation.

In a completely interconnected financial system where such a crisis leads to, no one knows. Speculation has been the name of the game, which takes companies after companies and nations to the brink of disaster, but we don’t learn the lessons. Banks, regulators and government all were ready to do what it takes to ride the speculation wave. All are generally made to feel normal, has been the modus operandi in all financial crises of this nature. Evergrande is China’s second largest property developer, riding on the property boom, expanded to 280 cities and became the real estate face. It owns more than 1,300 real estate projects. Nearly 30% of the Chinese economy comes from real estate. It was all the more reason it should have been properly regulated.

Evergrande is today saddled with the quantum of debt it cannot pay, totaling to USD 368 billion in loans to banks, as well as liabilities to contractors and suppliers. Evergrande, like other developers, bet on Chinese booming infrastructure build up. ”It took loans that often carried double digit interest rates and gambled that its sales of yet-to-be -built apartments would be enough to service ballooning debt.” Financial regulators tolerated these lending practices. These companies also took care of the land sales revenues of local governments. COVID-19 economic slowdown brought down the property prices. New govt policies to curb speculative investments put a limit to the number of homes people could purchase.

Today, it has turned out to be a Catch-22 situation. The fate of 1.4 million Evergrande units already paid for, hangs in a balance. Angry investors picket at its headquarters. Investment products from Evergrande has lost 90% of value this year. The company is set to default on at least one tranche of bond interest payments to around USD 120 million, due by the end of this month. Given the interdependent world market, it may not spell doom only to China, the ripples are likely to be felt far and wide. ”Investors worldwide have been spooked by the possibility of a default that could trigger a global financial crisis.”

ARE ALL SUCH FINANCIAL CRISES A RESULT OF WELL CALIBRATED SPECULATIVE PRACTICES IN OPERATION FOR A LONG TIME?

Sanjay Sahay