DailyPost 1826

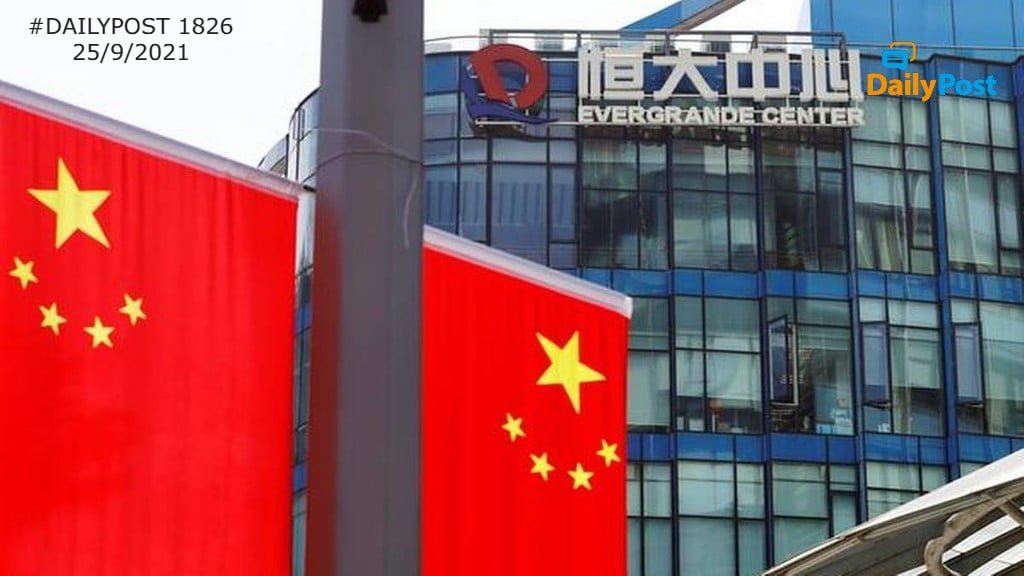

EVERGRANDE IMBROGLIO – IS IT MAN MADE?

When economic actions over a long period of time take place in a non-economic manner, with all stakeholders and the regulators closing their eyes, hoping for the economic bubble to last forever, crisis of this nature happens. The Lehman Brothers collapse, it seems has not taught anything to the world, now the repeat in different geography and in a totally different political system. If left unattended such fiascos will keep happening in our midst and financial chaos will visit us with even greater regularity. It will have spillovers which would be directly proportional to the response mechanism we have created to handle such crises; from the stakeholders to the government/s and the regulators, who in the first place have allowed it to happen.

That the stench of the financial stink was treated as a fragrance for so long, speaks volumes about the financial system we have created. As long as the cash registers keep on ringing there can be no wrong, is the thought process. It is not only self-defeating, in reality it aims at financial annihilation. Now scurrying for cover cannot take you places. Amongst general governance, corporate governance or financial regulatory mechanism, which can be termed the worst, cannot be decided even till the time the cows come home. We believe in a financial fairy world, to end up crashing again and again. Why facts don’t come to light, when it is in the making, is a million dollar question, which nobody has been able to answer to date, when we are hit by a crisis of any kind.

The founder chairman of Evergrande is currently estimated at $11.5 billion of which $8 billion is out of the cash dividends paid since Evergrande’s 2009 IPO on the Hongkong Stock Exchange. Though the company’s liabilities have kept on increasing every year since then, he has kept on getting dividends every year except 2016. With 80% stock decline this year and even if the company collapses, Hui Ka Yan, the chairman, would remain extraordinarily wealthy. This is the financial dichotomy of Evergrande. The down payment million + customers waiting for their apartments are in dire straits. ”If the lenders are aware of the fact that the use of the proceeds is to fund a dividend, they have to be more careful.”

The unfortunate part is that this impacts not only one company, its staff and customers, it could have a serious spillover effect on many Chinese sectors and could end up in massive job losses. ”The global economy will be impacted as foreign banks have exposure to Evergrande. The stock markets around the world had been jittery as the week started. Concerns are growing over the massive defaults. While stock markets around the world have rebounded slightly since then, experts are worried about the impact of the default on the global economy. The world and more so the stock markets keep a close watch on this unfolding financial crisis.

SUBJECTIVITY IN ECONOMIC DECISIONS AND FINANCIAL DEALINGS OVER A LONG PERIOD OF TIME HAVE GENERALLY ENDED UP IN DISASTER.

Sanjay Sahay